ebike tax credit california

Ad Enhance Your Daily Commute With Affordable Ebikes From a Time100 Most Influential Company. 2420 by Senator Brian Schatz of Hawaii.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The proposal would allow riders to claim one e-bike for individual taxpayers while allowing joint filers to credit up to two e-bikes.

. President Joe Bidens original Build Back Better proposal included a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500. But Senator Joe Manchin D-WV. The California Electric Bike Tax Credit is a tax credit that benefits people who buy electric bikes.

The program would allow a 30 rebate on purchases of e-bikes that cost up to 8000. If two family members acquired eBikes on a combined. The credits also phase out according to household income.

Credit for certain new electric bicycles. The tax credit is capped at a maximum of 900 and would only apply to electric bicycles priced under 4000 which includes a wide selection of quality e-bikes but rules out some of the most. To qualify the electric bicycle would have to.

The Electric Bicycle Incentive Kickstart for the Environment Act establishes a consumer tax credit of up to about thirty percent of the cost of an eBike purchase. What is the California Electric Bike Tax Credit. If passed e-bike buyers could claim a credit of up to 1500 for any e-bike purchased for service in the United States.

Under the Building Better Homes and Jobs Act of 2018 any person who makes less than 75000 per year can receive a tax credit of up to 900. California congressman wants to introduce a tax credit for e-bike purchases. It would provide a federal tax credit of 30 percent of the purchase value of an e-bike available once every three years capped at 1500 and applicable to e.

If the E-BIKE Act is eventually signed into law it would offer a 30 tax credit of up to 1500 for buying an electric bicycle. While both those bills were unsuccessful similar bills are expected to be introduced in 2021. 1019 by California Representative Jimmy Panetta and is once again gaining momentum thanks to 21 co-sponsors and a companion bill by the same name introduced in the US.

As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. The tax credit would be available to an individual once every three years or twice for a couple that files their tax returns jointly and buys two electric bicycles. The version of the social safety net and climate bill that was passed by the House of Representatives offers some Americans a fully refundable 30 tax credit on purchases of certain e-bikes.

A In general Subpart C of part IV of subchapter A of chapter 1 of the Internal Revenue Code of 1986 is amended by adding at the end the following new section. Electric bicycle tax credit 2022 credit is limited to either approximately 1500 or 30 of the entire cost whichever is lower. The E-BIKE Act is short and simple.

Additionally a federal bill was recently introduced titled the Electric Bicycle Incentive Kickstart for the Environment E-BIKE Act with a tax credit of 30 of an e-bike purchase price indicating that interest in incentivizing e-bikes is growing. The credit is worth up to 5000 per electric bike. Both bills have the same goal which is to allow a refundable tax credit for 30 of the cost of a qualified electric bicycle.

High Quality Feature Rich Affordable E-Bikes For The Masses. A Allowance of credit In the case of an individual there shall be allowed as a credit. Find The Right Fit For You.

This is not the motorcycle youre looking for. The e-bike tax credit would phase out at 75000 adjusted gross income for individual. The tax credit for your e-bike purchase is a percentage of the purchase price of the electric bike.

The E-BIKE Act is working its way through Congress but if passed consumers could get a tax credit worth up to 1500 on a new e-bike costing less than 8000. The credit can be used to reduce the amount. This is an electric bicycle.

It is available to residents of California who purchase an electric bike that costs 2500 or less.

It S Time For A Federal E Bike Tax Credit Outside Online

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

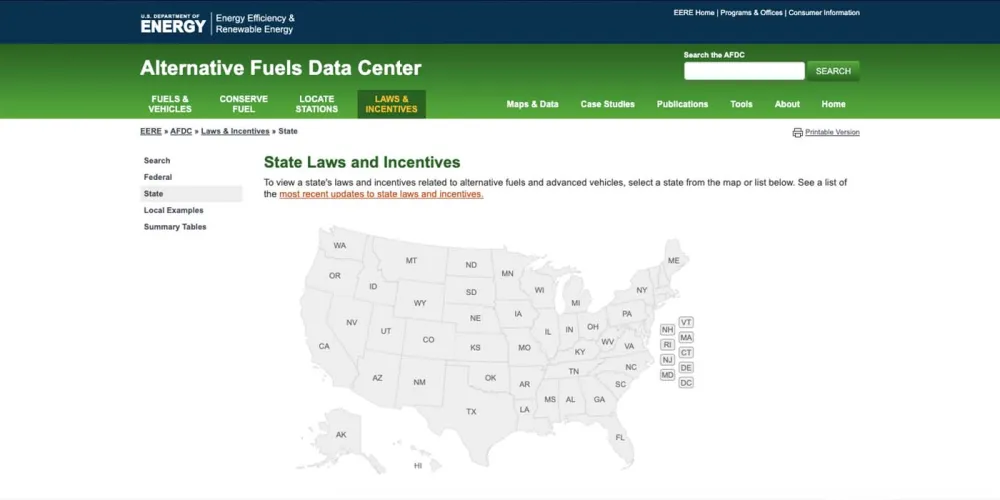

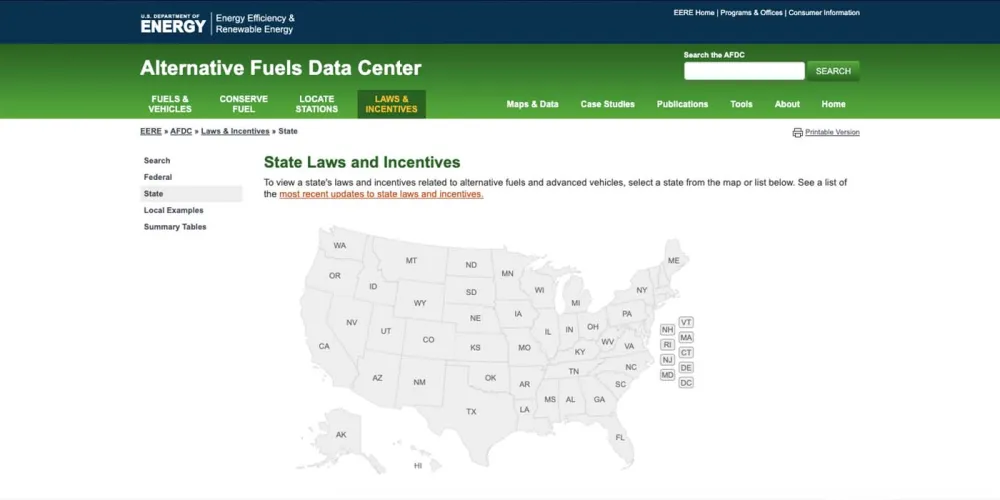

Electric Bicycle Incentives Go Local Peopleforbikes

Us E Bike Act For 30 Tax Credit Off Can You Get An Electric Bike For Hovsco

Ebike Rebates And Incentives Across The Usa

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

Understanding The Electric Bike Tax Credit

Porsche Race Cars Digitaldtour

Expanding The Rebate Program To Include E Bikes Would Not Only Nudge Many Who Are Considering Purchasing To Electric Bike Bikes For Sale Sustainable Transport

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Proposed Us E Bike Tax Credit Could Kickstart Biden S Clean Energy Revolution Cycling Weekly

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

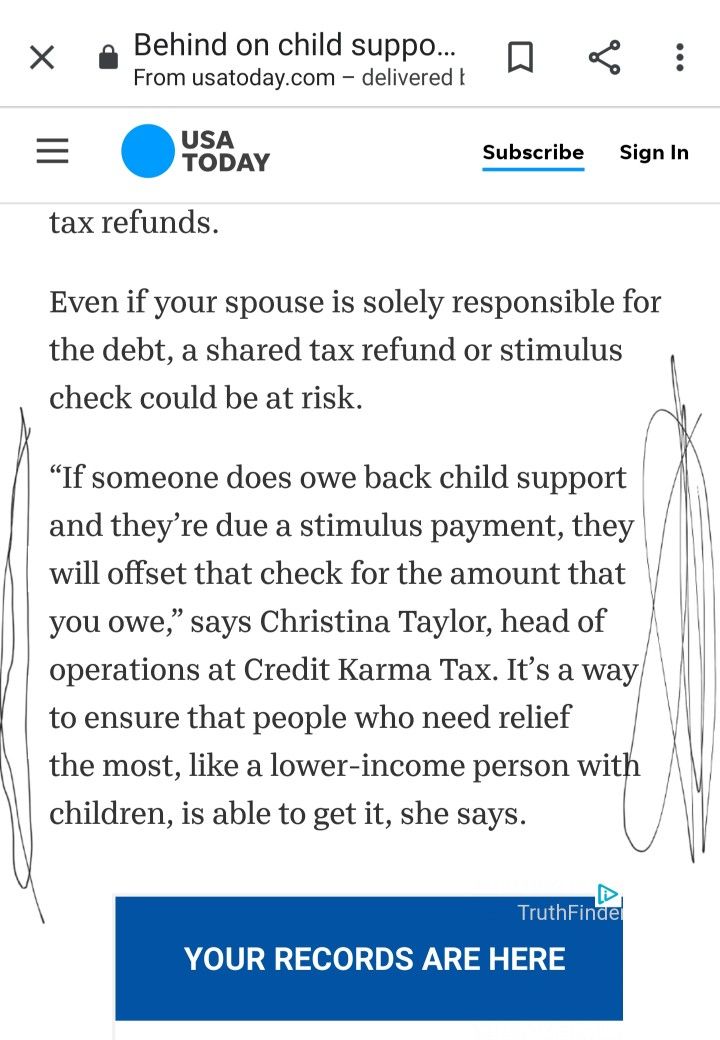

Pin By John Davis On Stuff Tax Refund Back Child Support Supportive

Ways And Means Committee Cuts E Bike Tax Credit In Half Bicycle Retailer And Industry News

Ev Tax Credit Calculator Forbes Wheels

Us E Bike Act For 30 Tax Credit Off Can You Get An Electric Bike For Hovsco

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Zero Reveals Its New 2021 Electric Motorcycle Lineup Electric Motorcycle Motorcycle New Electric Bike